|

Here is a 3-minute intraday chart of QQQ. First note the stock always stays within the Donchian Channel (it's mathematical - it's impossible to breakout). Overall, when the market is weak, note the tendency for QQQ to "ride" the channel down while occasioanally popping up to touch the top of the channel. The is typical action for a trending day.

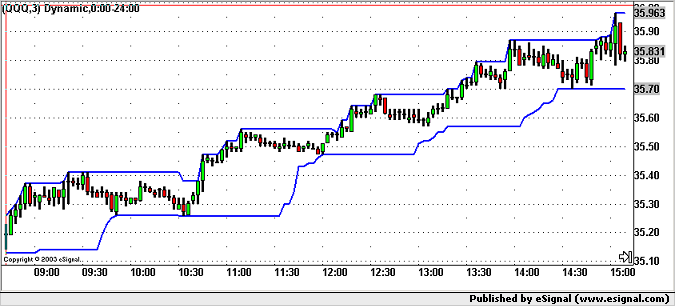

Here again is a 3-minute QQQ chart except the stock is obviously in a steady uptrend. Equal and opposite the bearish action, note the stock's tendency ride the upper part of the channel while occasionally pulling back to kiss the bottom channel line.

» back to top

|