|

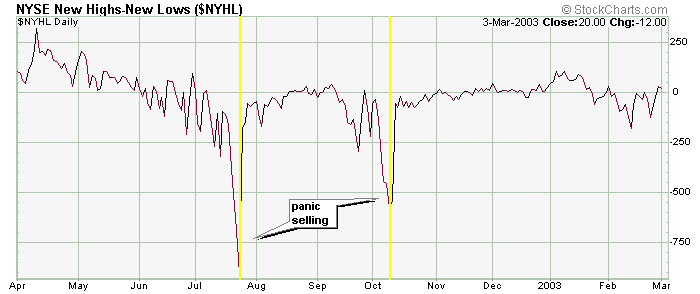

Here is a typical New Highs-New Lows chart. The line typically giggles above and below the zero line while occasionally spiking to an extreme level. You can see from the above chart that each time a bloody capitulation sell-off occured, the market bottomed short term.

These spikes are the only usefulness of the NH-NL line because the line spends so much time going nowhere.

» back to top

|