|

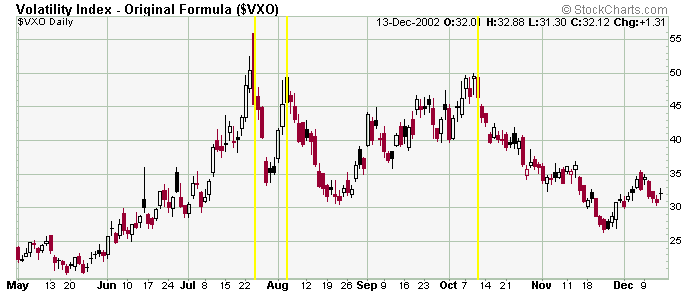

Here is a VXO chart during a 7-month period in late 2002. High readings indicate put option buyers paying a premium, but amateur options players are usually wrong. So high VXO readings, which coorespond to put buyers being wrong at exactly the wrong time should indicate a market bottom.

Here is the S&P 500 chart during this same time period. You can see each time the VXO spiked up, the SPX bottomed and bounced.

» back to top

|