|

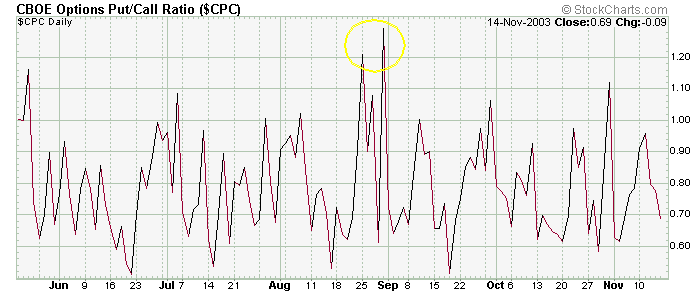

Here is a typical Put/Call line. It fluctuates wildly, and as you can see it spends most of its time below 1.0. This indicates call option volume usually beats put option volume. Spikes to the downside are not very useful, but spikes to the upside can indicate a panic by the bulls (they are buying puts to protect their holdings), and a bounce can occur.

Here is the NYSE chart during this same time period. The spike in the Put/Call line did indeed signal an end to the small pullback with an otherwise uptrending market.

» back to top

|