ATH was in a steady uptrend when it consolidated in an ascending triangle pattern. Resistance is not perfectly defined but the series of higher lows maintains the generally upward nature of the stock. Volume didn't exactly surge on the breakout, but the stock didn't pullback much so there was never a reason to get out (remember, volume is used as a confirmation – not a decision-making element). Eventually the bulls stepped up and provided a nice gain for those patient enough to stay with the position.

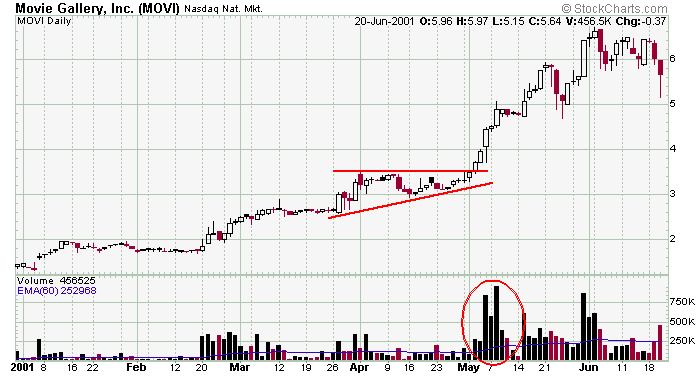

This is a textbook play for MOVI. Volume surge on the move into the pattern and then calmed down within the pattern. Then volume surged again on the breakout. This is exactly the type of action you want to see.

AGI was in a steady uptrend when it traded into and then exploded out of this ascending triangle pattern. Notice how resistance is very easy to determine (always a bonus when it's exact, and you don't have to estimate) and how volume dried up just prior to the breakout.

» back to top |