|

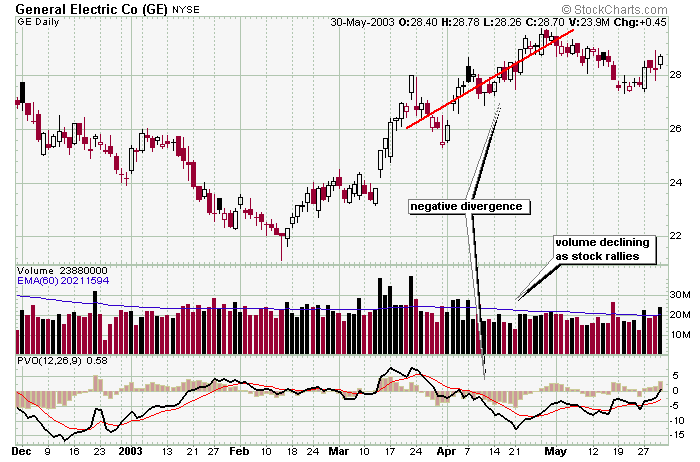

Here is an example of how PVO can be used when a negative divergence forms. As GE was moving up, volume was falling off, so the Volume Oscillator moved down. Although we would not necessarily recommend going short, the divergence is enough to raise a red flag if you are long.

» back to top

|