Bear Call Spread

Risk: low

Reward: low

General Description

Entering a bear call spread entails selling lower strike calls and buying an equal number of higher strike calls (same expiration month).

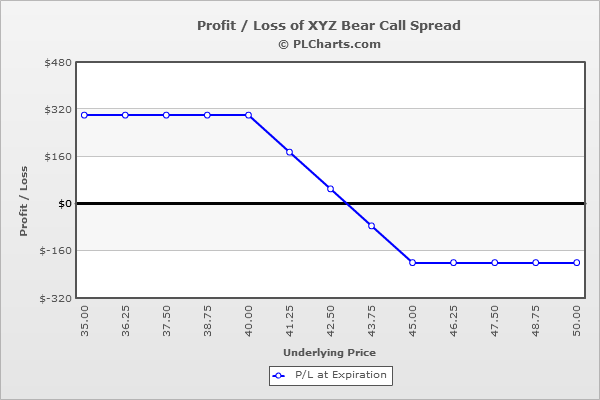

(draw a bear call spread risk diagram here)

The Thinking

You're bearish and are confident a stock will move down. So you sell a call (probably in-the-money) that will decline in value when the stock drops (hopefully below the strike price). But if the stock were to rally, you could suffer a big loss, so you buy a higher strike call to protect yourself. This strategy may be preferable over a bear put spread because you are primarily an option seller and therefore benefit from time decay.

Example

XYZ is at $43. You are bearish and think the stock will move down a few points but not much further. Instead of shorting the stock outright, which can be expensive, or employing a bear put spread, which has a net debit to initiate the trade and requires downside movement to profit, you employ a bear call spread, which benefits from time decay. You sell (1) 40 call for $4.00 and buy (1) 45 call for $1.00. The net credit is $3.00.

Below $40, all calls expire worthless, and your profit is the net credit collected when the trade was initiated. This is your max gain.

If the stock trades flat and closes at $43, the 40 call will have decreased in value from $4.00 to $3.00 ($1.00 gain), and the 45 call will have decreased in value from $1.00 to being worthless ($1.00 loss) for a breakeven trade. This is the benefit of being an option seller instead of a buyer. Even though the stock didn’t move, time decay enabled you to get out even.

At $45, the 40 call will have increased in value from $4.00 to $5.00 ($1.00 loss) and the 45 call will have decreased in value from $1.00 to being worthless ($1.00 loss) for a total loss of $2.00. This is your max loss.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|