Bull Put Spread

Risk: low

Reward: low

General Description

Entering a bull put spread entails selling higher strike puts and buying an equal number of lower strike puts (same expiration month).

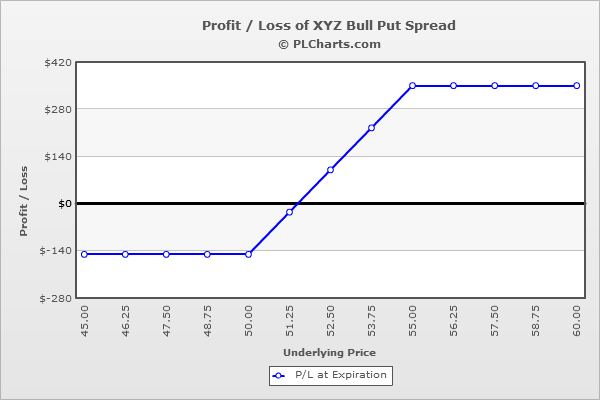

(draw a bull put spread risk diagram here)

The Thinking

You're bullish and are confident a stock will move up. So you sell a put (probably in-the-money) that will decline in value when the stock rallies (hopefully above the strike price). But if the stock were to drop, you could suffer a big loss, so you buy a lower strike put to protect yourself. This strategy may be preferable over a bull call spread because you are primarily an option seller and therefore benefit from time decay.

Example

XYZ is at $52. You are bullish and think the stock can rally a few points but don't think it will surge higher. Instead of buying the stock outright, which is expensive, or employing a bull call spread, which has a net debit to initiate the trade and requires upside movement to profit, you employ a bull put spread, which benefits from time decay. You sell (1) 55 put for $4.50 and buy (1) 50 put for $1.00. The net credit is $3.50.

Above $55, all puts expire worthless, and your profit is the net credit collected when the trade was initiated.

If the stock trades flat and closes at $52, the 55 put will have decreased in value from $4.50 to $3.00 ($1.50 gain), and the 50 put will have decreased in value from $1.00 to being worthless ($1.00 loss) for a profit of $0.50. This is a benefit of being an option seller instead of a buyer. Even though the stock didn’t move, time decay enabled you to get out with a small profit instead of a loss.

At $50, the 55 put will have increased in value from $4.50 to $5.00 ($0.50 loss), and the 50 put will have decreased in value from $1.00 to being worthless ($1.00 loss) for a total loss of $1.50.

Below $50.00, the loss from the short put and gain from the long put will cancel each other out.

The PL chart below graphically show where this trade will be profitable and at a loss.

|