Long Calls

Risk: limited

Reward: potentially very high

General Description

Entering a long call entails buying call options.

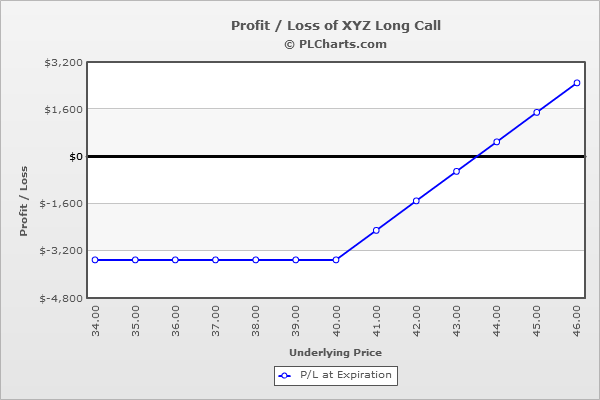

(draw a long call risk diagram here)

The Thinking

You're bullish; your research tells you a stock has the chance to experience a solid rally. Instead of buying the stock outright (which can be expensive), you buy call options. If you go deep in-the-money, the options will move close to point-for-point with the underlying (time decay is not much of a factor), but if you go out-of-the-money, the underlying will have to rally just to get above the strike and rally even further to overcome the premium paid. In either case, if your analysis is correct and the stock does indeed experience a huge rally, you'll be rewarded.

Example

XYZ is at $42, and your analysis tells you a move to the high 40's is possible. You could buy 1000 shares of the stock for $42,000 but instead opt to buy (10) 40 calls for $3.50 each.

Below $40 the calls expire worthless, and you'll lose your entire investment.

The breakeven is $43.50 (the strike plus the cost of the calls).

Above $43.5, you'll make money point for point with the underlying. If the stock moves to $50, the calls will have increased in value from $3.50 to $10.00 ($6.50 profit per contract).

The PL chart below graphically shows where this trade will be profitable and at a loss.

|