Bear Put Spread

Risk: low

Reward: low

General Description

Entering a bear put spread entails buying higher strike puts and selling an equal number of lower strike puts (same expiration month).

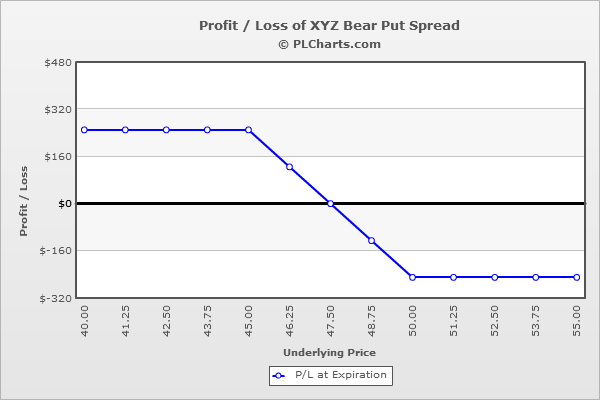

(draw a bear put spread risk diagram here)

The Thinking

You're bearish and are confident a stock will move down, but you don't think the stock will completely tank. You buy puts to profit when the stock drops, and then sell lower strike puts to 1) help pay for the long puts and 2) to lower your risk. Your breakeven is more favorable and your max loss potential is lower. If the stock drops, preferably below the lower strike, you'll profit.

Example

XYZ is at $48. You’re bearish and think the stock will move down a few points but not much further. You buy (1) 50 put for $3.50 and sell (1) 45 put for $1.00. The net debit $2.50.

Above $50, all the puts expire worthless, and your loss is the net debit paid when the trade was initiated.

If the stock trades flat and closes at $48, the 50 put will have declined in value from $3.50 to $2.00 ($1.50 loss) and the 45 put will have declined in value from being $1.00 to being worthless ($1.00 profit) for a total loss of $0.50.

If the stock drops to $45, the 50 put will have increased in value from $3.50 to $5.00 ($1.50 profit), and the 45 put will have declined in value from being $1.00 to being worthless ($1.00 profit) for a total profit of $2.50. This is your max profit.

Below $45, the profit from the long put and the loss from the short put cancel each other out.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|