Short Guts

Risk: unlimited

Reward: limited

General Description

Entering a short guts entails selling lower strike in-the-money calls and selling an equal number of higher strike in-the-money puts (same expiration date). It's similar to a short strangle, but instead of using out-of-the-money options, in-the-money options are used.

(draw a short guts risk diagram here)

The Thinking

You're confident a stock will trade in a tight range and not move much from its current position. To profit you sell both calls and puts - both of which decline in value when the underlying trades sideways (time decay). If you're correct, if the underlying stays relatively close to home (ideally between the two strikes), the calls and puts will declined in value, and you'll be able to buy them back at a lower price.

Example

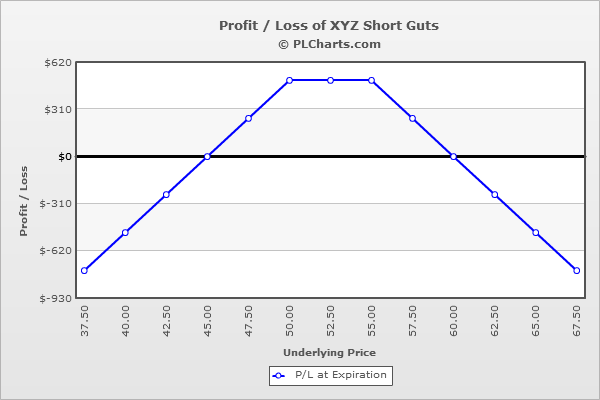

XYZ is at $52.50. You sell (1) 50 call for $5.00 and sell (1) 55 put for $5.00. The trade is initiated for a net credit of $10.00.

The max profit zone exits between the strikes, but because it would be impossible for both the call and put to expire worthless, the net credit is not your max profitability. Instead it’s much lower. As an example, at $52.5, the 50 call is worth $2.50 ($2.50 profit) and the 55 put is worth $2.50 ($2.50 profit) for a profit of $5.00. This is your max profitability.

The downside breakeven is 10 points (the net credit) below long put strike, and the upside breakeven is 10 points above the long call strike. So as long as the stock closes between $45 and $60 at expiration, you’ll make money. That’s a nice wide range, but in exchange for such a favorable situation, you have virtually unlimited loss potential to the downside and unlimited loss potential to the upside.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|