Covered Straddle

Risk: limited but very big

Reward: limited

General Description

Entering a covered straddle entails selling a straddle (sell equal number of calls and puts at the same strike and expiration month) on a stock you own. It's similar to a covered strangle expect the same strike is used for the options rather than consecutive strikes. Also, it can be thought of as a combination of covered call and naked put, which have the same risk profile. Hence, it's like employing two covered calls or two naked puts.

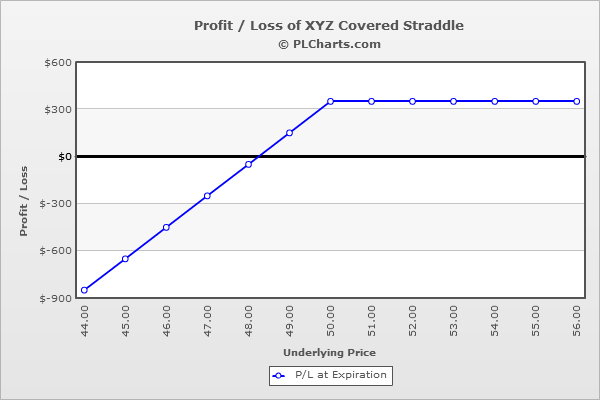

(draw a covered straddle risk diagram here)

The Thinking

You're moderately bullish and are confident a stock's downside is limited. This strategy is a combination of a covered call and naked put, which have the same risk profile. If the stock trades flat, you keep most of the call and put premiums and may or may not keep the stock depending on where the stock closes relative to the strike. If the stock moves up, you keep the option premiums, and the stock will most likely get "called" from you. If the stock moves down, you'll again keep the option premiums, but you'll get "put" the stock, so you'll now be long twice as many shares.

Example

XYZ is at $52. You're confident the stock will bounce around in a small range or move up slightly. To profit, you buy 100 shares of the stock at $52.00 and sell (1) 50 call for $4.00 and (1) 50 put for $1.50. The net credit is $5.50 plus the cost of the stock.

If the stock closes above $50, you'll keep the option premiums for a $5.50 profit, and the stock will get called away (bought at $52.00, sold at $50.00 for a $2.00 loss). The net of this is a $3.50 profit.

If the stock closes below $50, your loss can add up fast. You’ll lose money with both the long stock position and the short put. For example, at $40 you’ll be down 12 bucks with the stock and $8.50 with the put (you sold it for $1.50, now it’s worth $10). You do have a little extra buffer from the $4.00 collected from selling the call.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|