Long Strangle

Risk: medium

Reward: very high

General Description

Entering a long strangle entails buying lower strike puts and an equal number of higher strike calls (same expiration month). It's similar to a long straddle except the strikes are staggered instead of the same.

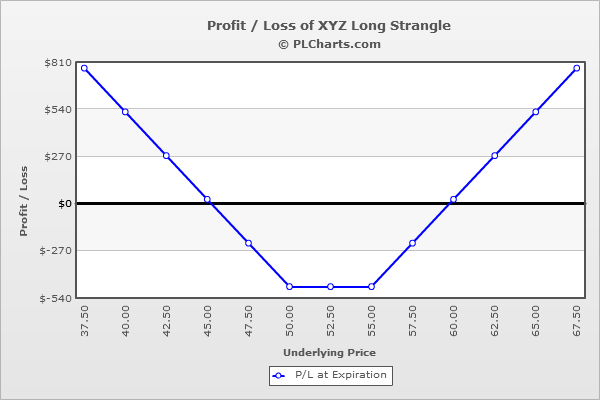

(draw a long strangle risk diagram here)

The Thinking

You're not bullish or bearish, but you do think a big move is coming and along with it, an expansion in volatility. If the stock rallies, hopefully it rallies enough so the profit from the long calls more than offsets the loss from the long puts. If the stock drops, hopefully it drops enough so the profit from the long puts more than offsets the loss from the long calls.

Example

XYZ is at $53, and your analysis says a big move is coming (earnings or some other big announcement). You buy (1) 55 call for $3.00 and (1) 50 put for $1.75. The net debit is $4.75

If the stock closes between the strikes ($50 and $55), the call and put will expire worthless, and you’ll incur a loss equal to the net debit.

Above $55, the puts will expire worthless, and the call will increase in value point-for point with the underlying. For example, at $65, the put will be worthless ($1.75 loss), and the call will be worth $10 (netting a profit of $7) for a total profit of $5.25.

Below $50, the call will expire worthless, and the put will increase in value point-for-point with the underlying. For example, at $40, the call will be worthless ($3.00 loss), and the put will be worth $10 (netting a profit of $8.25) for a total profit of $5.25.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|