Short Strangle

Risk: high

Reward: limited

General Description

Entering a short strangle entails selling lower strike puts and an equal number of higher strike calls (same expiration month). It's similar to a short straddle except the strikes are staggered instead of the same.

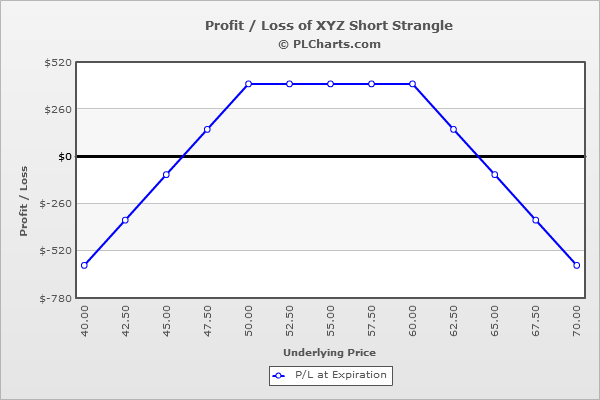

(draw a short strangle risk diagram here)

The Thinking

You're confident a stock will trade in a tight range and not move much from its current position. To profit you sell both calls and puts - both of which decline in value when the underlying trades sideways (time decay). If you're correct, if the underlying stays relatively close to home, the calls and puts will declined in value, and you'll be able to buy them back at a lower price or let them expire worthless.

Example

XYZ is at $55.00. The stock has just dropped quickly from $65.00 and is due for a rest. Also, because of the quick drop, volatility has spiked, so options are temporarily expensive. To profit from either some sideways grind or a crash in volatility, you employ a short strangle. You sell (1) 50 put for $2.00 and (1) 60 call for $2.00. The net credit is $4.00.

If volatility crashes, you could possibly buy the options back within a couple days for a decent profit even if the stock doesn’t move.

Absent a volatility crash, as long as the underlying closes between 50 and 60 on expiration, the calls and puts expire worthless, and you keep the net credit received when the trade was initiated.

But if the stock rallies hard or collapses, you could be in trouble because you have a naked call and naked put. If the stock rallied to $70, the put would expire worthless ($2.00 profit), and the call would be worth $10 ($8.00 loss). The net is a $6.00 loss. Not too bad considering how much the stock moved. If the stock dropped to $40, the call would expire worthless ($2.00 profit), and the put would be worth $10 ($8.00 loss). The net is a $6.00 loss. Again, not too bad considering how much the stock moved.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|