Long Put Ladder

Risk: limited but very big

Reward: limited

General Description

Entering a long put ladder entails selling (1) lower strike put, selling (1) middle strike put and buying (1) higher strike put (same expiration month). It can be thought of as a short put ratio spread which staggers the short puts instead of using the same strike. It's also similar to a higher strike bear put spread with an extra naked put at a lower strike.

(draw a long put ladder risk diagram here)

The Thinking

You're confident a stock will trade in a tight range or possibly move down slightly. A bear put spread will profit in such a situation because the decline in value of the long put will be more than offset by the time decay of the naked put. Then an additional put is sold at a lower strike. This helps finance the trade and results in a more favorable breakeven level.

Example

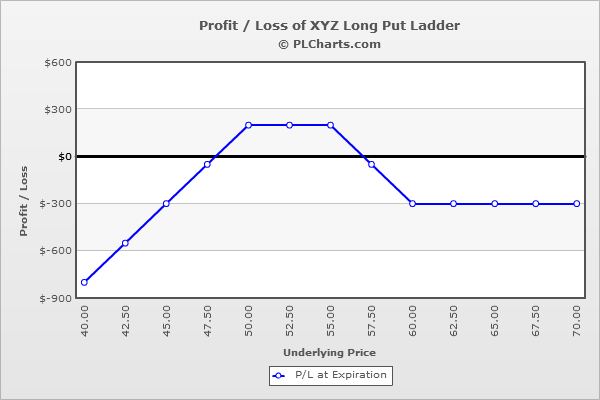

XYZ is at $55.00. You buy (1) 60 put for $7.00 and sell (1) 55 put for $3.00. This is a bear put spread. Then you sell (1) 50 put at $1.00. The net debit is $3.00.

Above the highest strike, all puts expire worthless, and your loss is the net debit paid when the trade was initiated.

Below the lowest strike, all puts expire in-the-money. The profit from the long put will be canceled out by the loss from one of the short puts, and the remaining short put will increase in value point-for-point with the underlying. For example, at $45, the 50 put will be worth $5 ($4.00 loss), the 55 put will be worth $10 ($7.00 loss) and the 60 put will be worth $15 ($8.00 gain). The net of this is a $4.00 loss, and the loss continues to grow as the stock drops.

Between the two lowest strikes ($50.00 and $55.00) max profitability is achieved. As an example, at $55, the 50 and 55 puts will expire worthless ($1.00 gain and $3.00 gain) and the 60 put will be worth $5 ($2.00 loss). The net is a $2.00 profit.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|