Protective Put

Risk: limited

Reward: unlimited

General Description

Entering a protective put entails buying puts on stock already owned. It's the same as a married put. Also, it has the same risk profile as a long call, so it's considered a type of synthetic long call.

(draw a protective put diagram here)

The Thinking

You own a stock and wish to remain long, but it just rallied a bunch and is due for a pullback. You buy puts to make a few bucks while the stock corrects. If the stock rallies, you keep the stock and lose the premium paid for the puts - the price of insurance. If the stocks drops, the paper loss from the stock falling with be easier to swallow because you'll make money with the long puts.

Example

XYZ is at $43, and you believe it has big upside potential - so big that you are willing to roll the dice with out-of-the-money long calls - but you'd like to lessen the loss incurred should the stock drop. You buy (3) 45 calls for $1.25 each and sell (1) 40 call for $3.50. The net debit is $0.25 (you collected $3.50 for the short call and paid $1.25 for each of the long calls).

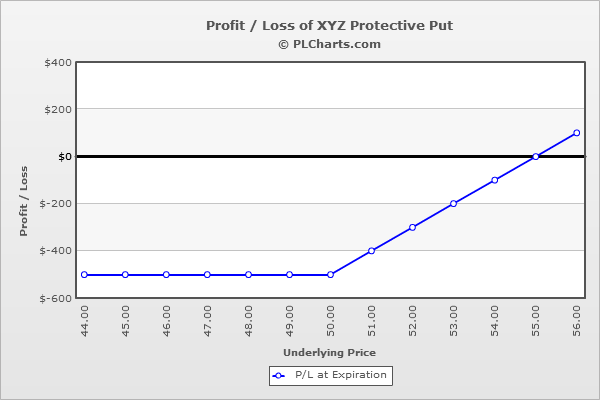

You've been the proud owner of XYZ for many years. You want to keep the stock and continue collecting dividends, but because the entire market has started to move down, you are a little worried XYZ will do the same. The stock is currently at $50, so you buy (1) 50 put at $5.00 for an expiration date six months out.

If the stock closes above $50, the put expire worthless, and you’re out the net debit. At least you keep the stock and benefit from ownership (stock appreciation, dividends etc.)

Below $50, the loss from the stock will be countered by a gain from the long put – exactly what you wanted, to keep the stock and protect your downside.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|