Long Call Condor

Risk: low

Reward: low

General Description

Entering a long call condor entails buying (1) lower strike call, selling (1) middle strike call, selling (1) higher middle strike call and buying (1) higher strike call (same expiration month, distance between the two lower legs is equal to the distance between the two upper legs). It's essentially a combination of a lower strike bull call spread and a higher strike bear call spread, and it's similar to a long call butterfly except the short calls are spread out over two strikes.

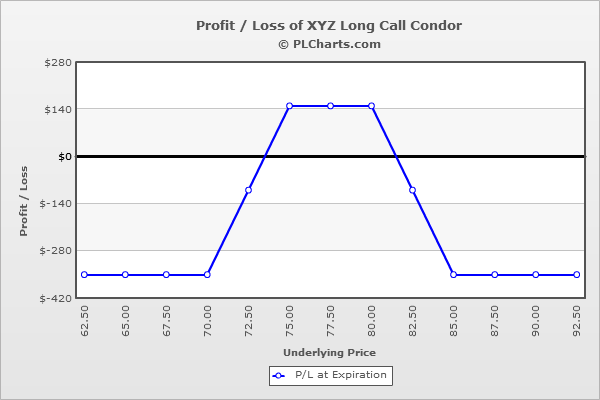

(draw a long call condor risk diagram here)

The Thinking

You're confident a stock will trade in a tight range and not move much from its current position. You employ a lower strike bull call spread, which achieves max profitability when the stock rallies, and a higher strike bear call spread, which achieves max profitability when the stock drops. If you're correct, if the stock doesn't stray too far (preferably stays between the two middle strikes), you'll make money on both legs of the overall strategy.

Example

XYZ is trading at $77.50. You buy (1) 70 call for $8.50, sell (1) 75 call for $4.00, sell (1) 80 call for $1.50 and buy (1) 85 call for $0.50. The net debit is $3.50.

Below the lowest strike, all calls expire worthless, and your loss is the net debit paid when the trade was initiated.

Above the highest strike, all calls are in-the-money and exactly cancel each other out. Your loss is the net debit paid when the trade was initiated. For example, if the stock is at $90, 70 call will be worth $20 ($11.50 gain), the 75 call will be worth $15 ($11.00 loss), the 80 call will be worth $10 ($8.50 loss) and the 85 call will be worth $5 ($4.50 gain). The net of this is a $3.50 loss.

Between the middle strikes ($75 and $80), max profitability is achieved. After all, that’s where the lower bull call spread and upper bear call spread are both in their max profit zones. As an example, at $77.5, the 70 call will be worth $7.5 ($1.00 loss), the 75 call will be worth $2.5 ($1.50 gain), the 80 call will be worthless ($1.50 gain) and the 85 call will be worthless ($0.50 loss). The net of this is $1.50 profit.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|