Synthetic Short Stock

Risk: limited

Reward: limited but very big

General Description

Entering a synthetic short stock entails buying puts and selling an equal number of calls at the same strike (same expiration month). It's similar to a synthetic short stock (split strike) except the same strike is used instead of consecutive strikes.

(draw a synthetic short stock risk diagram here)

The Thinking

You're bearish and are confident a stock will move down. Instead of shorting the stock outright, which is expensive, you replicate the gain/loss you would experience if you were short for a fraction of the cost.

Example

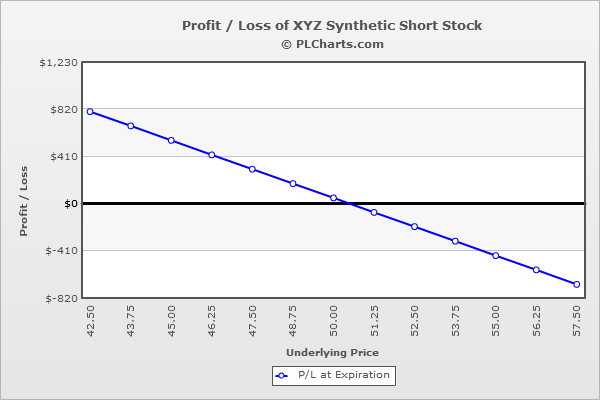

XYZ is at $50.00. Instead of shorting the stock, you sell (1) 50 call for $4.00 and buy (1) 50 put for $3.50. The net credit is $0.50.

If the stock moves down to $40 at expiration, the 50 put will be worth $10 (netting you a profit of $6.50), and the calls will be worthless (netting you a profit of $4.00). Your total profit is $10.50 (because of the different in premium between the call and put, your profit isn't $10.00).

If the stock moves up to $60 at expiration, the 50 put will be worthless (netting you a loss of $3.50), and the 50 call will be worth $10 (netting you a loss of $6.00). The total loss is $10.50 (again because of the difference in premiums when the trade was initiated).

So this trade pretty closely mimics what it’d be like if you just shorted the stock outright, but it’s not perfect.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|