Protective Call

Risk: limited

Reward: limited but very big

General Description

Entering a protective call entails buying calls against a stock you are short. It has the same risk profile as a long put, so it's considered a type of synthetic long put.

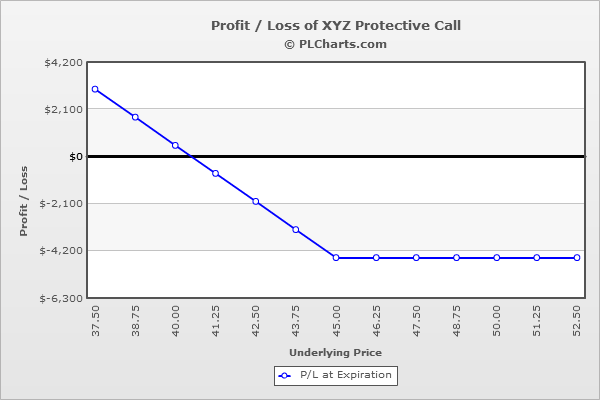

(draw a protective call risk diagram here)

The Thinking

You're short a stock, but in the near term you believe a bounce is coming. Instead of covering your short with intentions of re-shorting at a higher level (may have negative tax consequences), you buy calls to make a few bucks on the bounce. If the stock rallies, you make a few bucks to cover the loss from your short stock position. If the stock drops, you'll still get to participate.

Example

XYZ is at $42. You've been short 1000 shares of XYZ and want to remain short, but your analysis says an oversold bounce is coming. With the goal of making a few bucks on a bounce to buffer the paper loss you’ll incur by staying short you buy (10) 45 calls for $1.50 each.

Below $45, the calls expire worthless and are nothing more than unused insurance.

Above $45, your loss with the stock will be offset by a gain in the calls. For example, if XYZ rallies to $55, you’ll have a $13.00 paper loss on the stock (relative to $42), and an $8.50 gain on the calls (you bought them for $1.50, now they’re worth $10). The net is a $4.50 loss – better than a $13.00 loss.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|