Strip

Risk: limited

Reward: unlimited

General Description

Entering a strip entails buying calls and buying twice as many puts at the same strike (same expiration date). It's similar to a long straddle and strap, but with the puts out-numbering calls, your bias is to the downside.

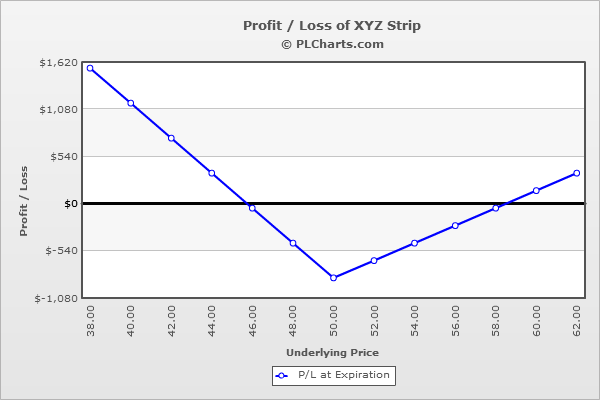

(draw a strip risk diagram here)

The Thinking

Your analysis tells you a big move is coming. You aren't sure of the direction, but you favor the downside. You enter a long straddle trade with an extra put in hopes of a move down. If you get the move you expect, you'll profit. If the stock moves up, that's fine too, but you'll need a pretty big move just to get back to breakeven.

Example

XYZ is at $50. Your analysis says a big move is coming, but you aren't sure of the direction, although you favor the downside. You buy (1) 50 call for $3.00 and (2) 50 puts for $2.75 each. The net debit is $8.50.

If the stock doesn’t move, all options expire worthless, and you incur a loss equal to the net debit paid to initiate the trade.

Above $50, the puts will expire worthless, and the call will increase in value point-for-point with the underlying. For example, at $65, the puts will be worthless ($2.75 loss per contract), and the call will be worth $15.00 ($12.00 profit). The net is a $6.50 profit.

Below $50, the call will expire worthless, and the puts will increase in value point-for-point with the underlying. For example, at $35, the call will be worthless ($3.00 loss), and the puts will be worth $15.00 ($12.00 profit per contract). The net is a $21.00 profit.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|