Covered Calls

Risk: low

Reward: low

General Description

Entering a covered call entails selling calls against a long stock position.

(draw a covered call risk diagram here)

The Thinking

There are two main purposes of this strategy. 1) You're long a stock and want to generate monthly or quarterly cash flow while maintaining ownership of the stock. You sell out-of-the-money calls against your position. As long as the stock closes below the strike price at expiration, you keep the stock and can sell calls again. Collecting a couple % each month or quarter adds up; it's like collecting a monthly or quarterly dividend. 2) You buy a stock specifically for the purpose of selling calls, and while it may be nice for the stock to close just below the strike at expiration so you can sell calls again, you're perfectly ok with the stock rallying and getting called from you. This is typically done with a volatile stock which fetches a high premium.

Example

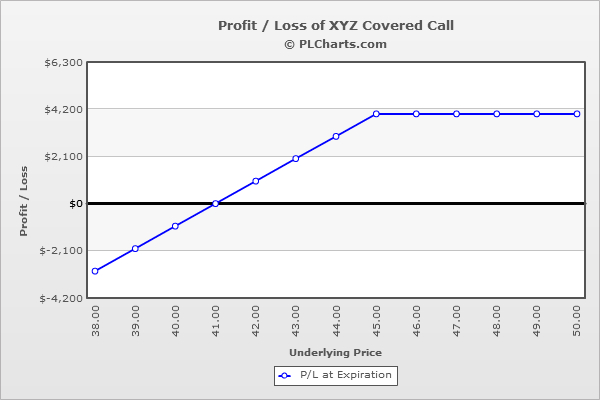

You've been the proud owner of 1000 shares of XYZ for several years. It's a quiet stock which has treated you well, but you'd like to use covered calls to generate a little cash flow. The stock is at $42. You sell (10) 45 calls for $1.00 each.

As long as the stock closes below $45 on expiration day, you keep the call premium and the stock. But if the stock were to rally above $45, the stock would get “called” from you unless you bought the calls back before they expired.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|