Put Ratio Spread

Risk: limited but very big

Reward: limited

General Description

Entering a put ratio spread entails buying higher strike puts and selling more lower strike puts (same expiration month). It can be thought of as a short put ratio spread, but the ratio of short to long puts is not locked at 2:1.

(draw a strap risk diagram here)

The Thinking

Your research tells you a stock has modest downside potential but will not collapse and will not experience a big expansion in volatility. You enter a bear put spread to profit from such movement and then sell additional puts at the lower strike. This helps finance the trade and results in a more favorable breakeven level.

Example

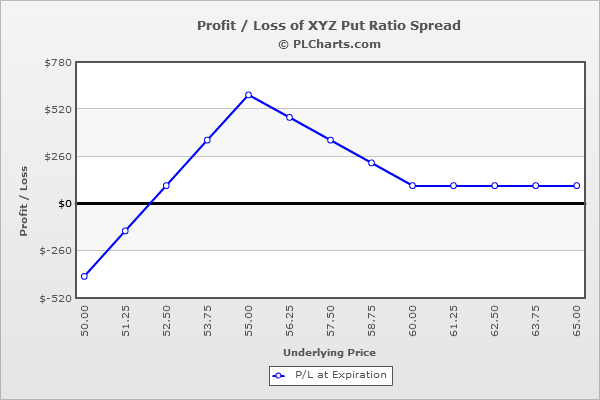

XYZ is at $57.50. You think the stock could move down a couple points but a big move down is not in the cards. You buy (1) 60 put for $5.00 and then sell (3) 55 puts for $2.00 each. The net credit is $1.00.

Above the highest strike, all puts expire worthless, and your profit or loss is the net credit or net debit; in this case it’s a $1.00 profit.

At $55, your max profitability occurs. The 60 puts will be worth $5 (breakeven), and the 55 puts will expire worthless ($2.00 gain per contract). The net of this is a $6.00 profit.

Below $55, the loss from one of your short puts will be countered by a gain from the long put, and the two remaining short puts will lose you money point-for-point with the underlying. For example, at $50, the 60 put will be worth $10 ($5 gain), and the 55 puts will be worth $5 ($3.00 loss per contract). The net is a $4.00 loss.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|