Short Call Ladder

Risk: limited

Reward: unlimited

General Description

Entering a short call ladder entails selling (1) lower strike call, buying (1) middle strike call and buying (1) higher strike call (same expiration month). It's essentially a bear call spread with an additional long call at a higher strike.

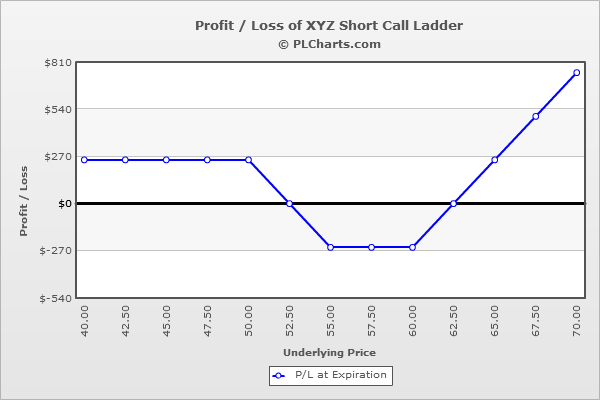

(draw a short call ladder risk diagram here)

The Thinking

Your analysis tells you a big move is coming, and you favor the upside. You enter a bear call spread, which has limited profit potential to the downside, and then buy an extra call that has unlimited profit potential to the upside. If the stock drops below the lowest strike, you'll profit (the gain from the bear call spread will be greater than the loss from the long call). But ideally the stock will rally big time, and your profit from the long call more than makes up for the loss of the bear call spread.

Example

XYZ is at $55. Your research says a big move is coming, but you favor the upside because the overall market is moving in that direction. You enter a bear call spread by selling (1) 50 call for $7.00 and buying (1) 55 call for $3.50. Then you buy (1) 60 call for $1.00. The entire trade is initiated for a net credit of $2.50

Below $50 (the lowest strike), all calls expire worthless, and your profit is the net credit received when the trade was initiated.

Above $60 (the highest strike), all calls expire in-the-money. The profit from one of your long calls will be canceled out by the loss from your short call, and then the remaining long call will increase in value point-for-point with the stock. For example, at $65, the 50 call will be worth $15 ($8.00 loss), the 55 call will be worth $10 ($6.50 profit) and the 60 call will be worth $5.00 ($4.00 profit). The net is a $2.50 profit.

Between the two higher strikes ($55 and $60), the max loss is suffered. That’s where the profit from the short call won’t be enough to offset the loss from the long calls. For example, at $55, the 50 call will be worth $5.00 ($2.00 profit), and both long calls will expire worthless ($3.50 loss on the 55, $1.00 loss on the 60). The net of this is a $2.50 loss.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|