Naked Put

Risk: high

Reward: limited

General Description

Entering a naked put entails selling puts.

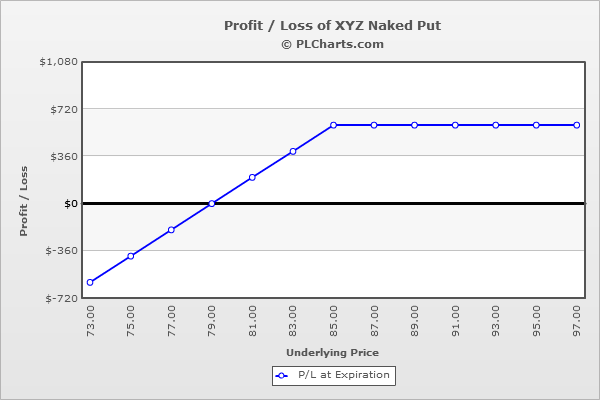

(draw a naked put risk diagram here)

The Thinking

You're moderately bullish on a stock and are very confident the downside is limited (these are two different thoughts). Instead of buying a call, which requires a net debit and some upside movement just to get to breakeven, you sell puts, which results in a net credit. Being a seller means time decay works in your favor, so even if the stock doesn't move, you'll profit.

Example

XYZ is at $82, and you believe the downside is very limited and the stock will hold this level or move up in the near term. You sell the (1) 85 put for $6.00.

Above $85, the put expires worthless, and you keep the entire premium collected.

If the stock is unchanged on expiration day, the put will decline in value from $6.00 to $3.00 ($3.00 profit).

Your breakeven is at $79 ($85 strike - $6 premium).

Below $79, you'll lose money point-for-point with the underlying, and if you don't close out the trade, the stock will be assigned to you.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|