Synthetic Short Put

Risk: unlimited

Reward: limited

General Description

Entering a synthetic short put entails selling calls on a stock you own. It has the same risk profile as a naked put (short put) (hence why it's considered a synthetic short put), but it's actually just a covered call.

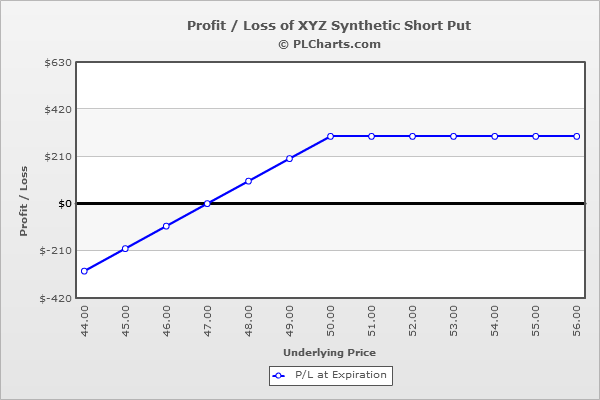

(draw a synthetic short put risk diagram here)

The Thinking

You want the benefits of stock ownership (collecting dividends, potential price appreciation), but you want some downside protection.

Example

XYZ is at $51. You’re confident a move down is very unlikely and the upside is limited. You wish to employ a strategy that profits from flat-ish movement and prefer a strategy that benefits from time decay. Also, you don’t necessary want or need to keep the stock. You buy 100 shares at $51.00 and then sell (1) 50 call for $4.00.

If the stock drops below $50.00, you'll keep the stock and the call premium collected.

If the stock closes above $50.00, you'll still keep the premium collected, but the stock will get “called” from you.

The shape of the P&L curve is identical to a short put (hence the name, synthetic short put), but this is really just a covered call.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|