Synthetic Long Call

Risk: limited

Reward: unlimited

General Description

Entering a synthetic long call entails buying puts against a stock you already own (or are currently buying). It has the same risk profile as a long call (hence why it's considered a synthetic long call); married put and protective put are types of synthetic long calls.

(draw a synthetic long call risk diagram here)

The Thinking

You want the benefits of stock ownership (collecting dividends, potential price appreciation), but you want some downside protection.

Example

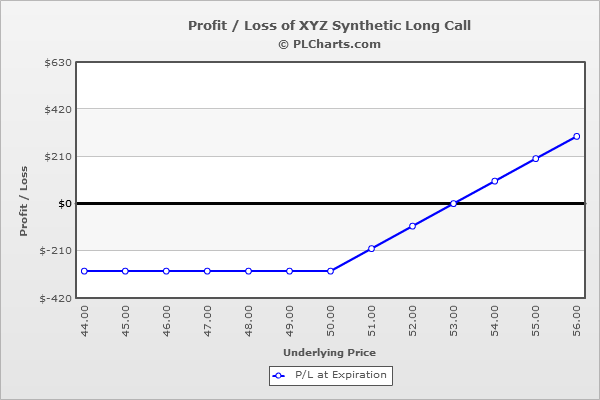

XYZ is at $50. You want to buy the stock to benefit from both a move up and dividend payments but are weary of a move down because the overall market is weakening. You buy 100 shares of the stock at $50 and then buy (1) 50 put for $3.00.

If the stock closes above $50, the puts expire worthless, and you’re out the net debit. At least you keep the stock and benefit from ownership (stock appreciation, dividends etc.).

Below $50, the loss from the stock will be countered by a gain from the long put. You loss is capped at $3, the put premium paid.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|