Strap

Risk: limited

Reward: unlimited

General Description

Entering a strap entails buying puts and buying twice as many calls at the same strike (same expiration date). It's similar to a long straddle and strip, but with the calls out-numbering puts, your bias is to the upside.

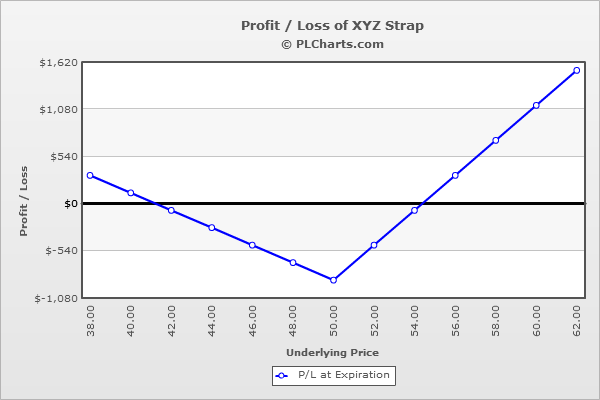

(draw a strap risk diagram here)

The Thinking

Your analysis tells you a big move is coming. You aren't sure of the direction, but you favor the upside. You enter a long straddle trade with an extra call in hopes of a move up. If you get the move you expect, you'll profit. If the stock moves down, that's fine too, but you'll need a pretty big move just to get back to breakeven.

Example

XYZ is at $50. Your analysis says a big move is coming, but you aren't sure of the direction, although you favor the upside. You buy (2) 50 calls for $3.00 each and (1) 50 put for $2.75. The net debit is $8.75.

If the stock doesn’t move, all options expire worthless, and you incur a loss equal to the net debit paid to initiate the trade.

Above $50, the put will expire worthless, and the calls will increase in value point-for-point with the underlying. For example, at $65, the put will be worthless ($2.75 loss), and the calls will be worth $15.00 ($12.00 profit per contract). The net is a $21.25 profit.

Below $50, the calls will expire worthless, and the put will increase in value point-for-point with the underlying. For example, at $35, the calls will be worthless ($3.00 loss per contract), and the put will be worth $15.00 ($12.00 profit). The net is a $6.00 profit.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|