Long Put Synthetic Straddle

Risk: limited

Reward: unlimited

General Description

Entering a long put synthetic straddle entails buying (2) puts for every 100 shares of stock you own. The risk profile is identical to a long straddle.

(draw a long put synthetic straddle risk diagram here)

The Thinking

You're not bullish or bearish, but you do think a big move is coming and along with it, an expansion in volatility. But you're already long the stock. Instead of employing one of the various strategies that profits from a big move in either direction (such as a long straddle), you wish to use your long stock position to synthetically mimic such a strategy. This can be done by buying puts. If the underlying rallies, your long stock will net you a profit (granted it has to rally enough to compensate you for the net debit incurred by buying the puts). If the stock drops, the gains from one of the long puts will cancel out the loss from the long stock, and the remaining long put will net you a profit (again, once the stock has moved up enough to pay for the net debit).

Example

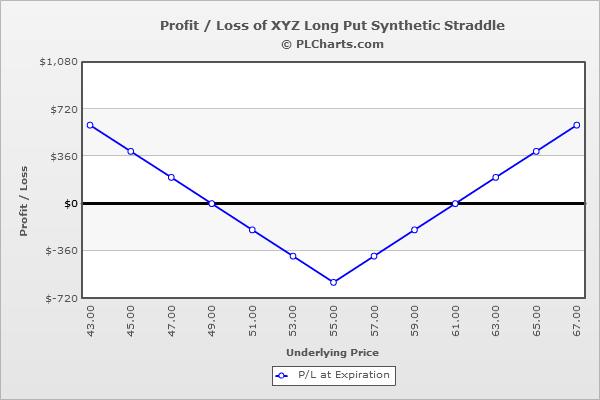

XYZ is at $55. You buy 100 shares of the stock at $55.00 and then buy (2) 55 puts at $3.00 each. The net debit is $6.00 plus the cost of the stock.

If the stock closes at $55 on expiration day, the puts expire worthless, and you’ll lose the net debit paid to initiate the trade.

If the stock rallies, you’ll make money point-for-point with the stock, but the stock will have to rally 6 points to compensate you for the total loss of the puts which will expire worthless. For example, at $65, you’ll be up $10 on the stock, but the puts will expire worthless ($6.00 loss). The net will be a $4.00 profit.

If the stock drops, the loss from the stock position will be countered by a gain from one of the long puts, and the other long put will increase in value point-for-point with the underlying. But like the needed upside move, the stock has to move 6 points in-the-money before this remaining put will start making you money. For example, at $45, you’ll be down $10 on the stock, and the puts will be worth $10 each ($7.00 profit each). The net will be a $4.00 profit.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|