Short Straddle

Risk: high

Reward: medium

General Description

Entering a short straddle entails selling an equal number of puts and calls at the same strike (same expiration month). It's similar to a short strangle except the strikes are the same instead of staggered.

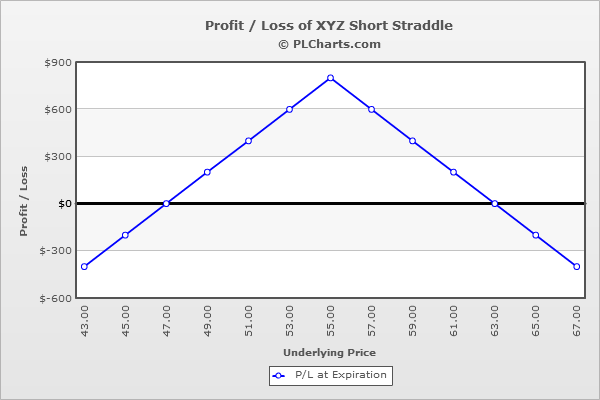

(draw a short straddle risk diagram here)

The Thinking

You're confident a stock will trade in a tight range and not move much from its current position. To profit you sell both calls and puts - both of which decline in value when the underlying trades sideways (time decay). If you're correct, if the underlying stays relatively close to home, the calls and puts will decline in value, and you'll be able to buy them back at a lower price.

Example

XYZ is at $55. The stock has just dropped quickly from $65.00 and is due for a rest. Also, because of the quick drop, volatility has spiked, so options are temporarily expensive. To profit from either some sideways grind or a crash in volatility, you employ a short straddle. You sell (1) 55 put for $4.00 and (1) 55 call for $4.00. The net credit to initiate the trade is $8.00.

If volatility crashes, you could possibly buy the options back within a couple days for a decent profit even if the stock doesn’t move.

At $55.00, the calls and puts will expire worthless, and you'll keep the net credit received when the trade was initiated.

But if the stock rallies hard or collapses, you could be in trouble because you have a naked call and naked put. If the stock rallied to $70, the put would expire worthless ($4.00 profit), and the call would be worth $15 ($11.00 loss). The net is a $7.00 loss. If the stock dropped to $40, the call would expire worthless ($4.00 profit), and the put would be worth $15 ($11.00 loss). The net is a $7.00 loss.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|