Long Puts

Risk: limited

Reward: very big

General Description

Entering a long put entails buying put options.

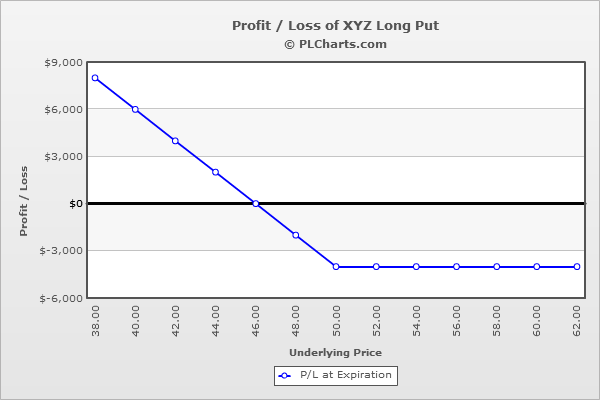

(draw a long put risk diagram here)

The Thinking

You're bearish; your research tells you a stock has a chance to experience a solid correction. Instead of shorting the stock (which may be expensive or not possible), you buy put options. You can buy out-of-the-money puts that are cheap (you're rolling the dice that a huge move down is coming) or in-the-money puts that will move close to point-for-point with the underlying. If your analysis is correct, and the stock does indeed drop, you'll be rewarded.

Example

XYZ is at $47, and your analysis tells you a move to the low 40's is coming. You could short 1000 shares of the stock for $47,000 but instead opt to buy (10) 50 puts for $4.00 each.

Above $50 the puts expire worthless, and you’ll lose your entire investment.

The breakeven is $46 (the strike minus the cost of the puts).

Below $46 you’ll make money point for point with the underlying. For example, if the stock moves to $40, the puts will have increased in value from $4.00 to $10.00 ($6.00 profit per contract).

The PL chart below graphically shows where this trade will be profitable and at a loss.

|