Synthetic Short Call

Risk: unlimited

Reward: limited

General Description

Entering a synthetic short call entails selling puts against a stock you are short. Covered put is a type of synthetic short call.

(draw a synthetic short call risk diagram here)

The Thinking

You're short a stock, but in the near term you believe a bounce is coming. Instead of covering your short with intentions of re-shorting at a higher level (may have negative tax consequences), you sell puts to make a few bucks on the bounce. If the stock closes above the strike, you keep the premium - mission accomplished. You'll also make money with time decay if the stock moves sideways.

Example

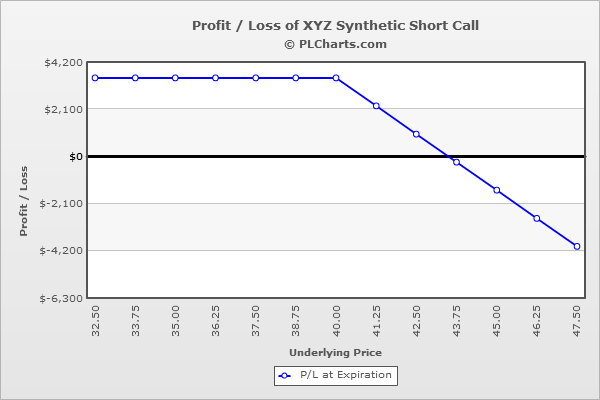

XYZ is at $42. You've been short 1000 shares of XYZ and want to remain short, but your analysis says an oversold bounce is coming. With the goal of making a few bucks on a bounce to buffer the paper loss you’ll incur by staying short you sell (10) 40 puts for $1.50 each.

As long as the stock closes above $40 on expiration day, you keep the put premium and remain short the stock.

Below $40, if you don’t close out the short put position, you'll get assigned the stock. Then you’ll be long and short the stock, so you’ll effectively be flat.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|