Ratio Call Write

Risk: unlimited

Reward: limited

General Description

Entering a ratio call write entails selling (2) calls for every 100 shares of stock you own. It's the same as a short call synthetic straddle, and its risk profile is identical to a short straddle.

(draw a ratio call write risk diagram here)

The Thinking

You are long a stock and confident it will trade in a tight range and won't move much from its current level. To profit from a lack of movement, selling options, which benefit from time decay, is a good route to go. If the stock moves up a little or down a little, you'll profit. It would take a relatively big move for the trade to lose you money.

Example

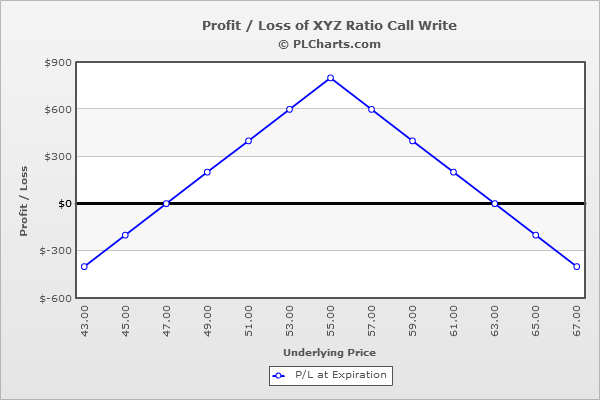

XYZ is at $55.00. You buy 100 shares of the stock at $55.00 and then sell (2) 55 calls at $4.00 each. The net credit is $8.00, not including the cost of the stock.

If the stock closes at $55 on expiration day, the calls expire worthless, and your profit is the net credit received.

If the stock rallies, the profit from the long stock will be countered by the loss from one of the short calls, and the other short call will continue to lose you money point-for-point with the underlying. For example, at $70, the long stock will be posting a $15 gain while the 55 calls will be worth $15 ($11.00 loss per contract). The net is a $7.00 loss.

If the stock drops, the calls will expire worthless, and the long stock position will lose you money point-for-point with the underlying. For example, at $40, the calls will be worthless ($4.00 gain per contract), and the stock will be down $15. The net is a $7.00 loss.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|