Naked Calls

Risk: high

Reward: limited

General Description

Entering a naked call entails selling calls.

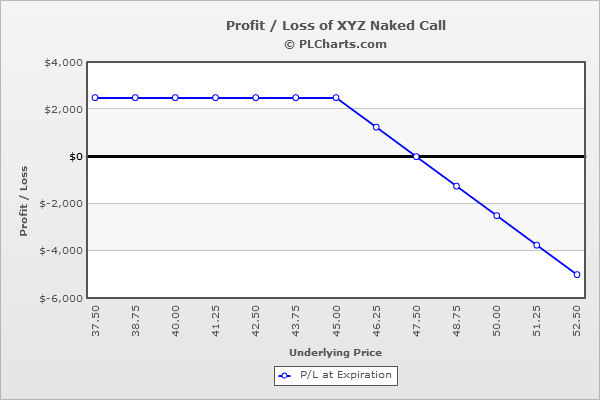

(draw a naked call risk diagram here)

The Thinking

You're moderately bearish on a stock and are very confident the upside is limited. Instead of buying puts, which requires a net debit and some downside movement just to get to breakeven, you sell calls, which results in a net credit. Being a seller means time decay works in your favor, so even if the stock doesn't move, you'll profit.

Example

XYZ is at $44, and you believe the upside is very limited and the stock will either hold its current level or drop in the coming weeks. You sell (10) 45 calls for $2.50.

Below $45, the calls expire worthless, and you keep the entire premium collected.

Your breakeven is at $47.50 ($45 strike + $2.50 premium).

Above $47.50, you’ll lose money point-for-point with the underlying. For example, if XYZ moves to $55, the calls, which you sold for $2.50, will be worth $10.00, so you'll have a $7.50 loss per contract. A brokerage firm should not approve you for naked calls unless you have significant experience and a big trading account.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|