Synthetic Short Stock (split strikes)

Risk: limited

Reward: limited but very big

General Description

Entering a synthetic short stock w/ split strikes entails buying puts and selling an equal number of calls at a higher strike (same expiration month). It's similar to a synthetic short stock except consecutive strikes are used instead of the same strike.

(draw a synthetic short stock w/ split strikes risk diagram here)

The Thinking

You're bearish and are confident a stock will move down. Instead of shorting the stock outright, which is expensive, you replicate the gain/loss you would experience if you were short for a fraction of the cost.

Example

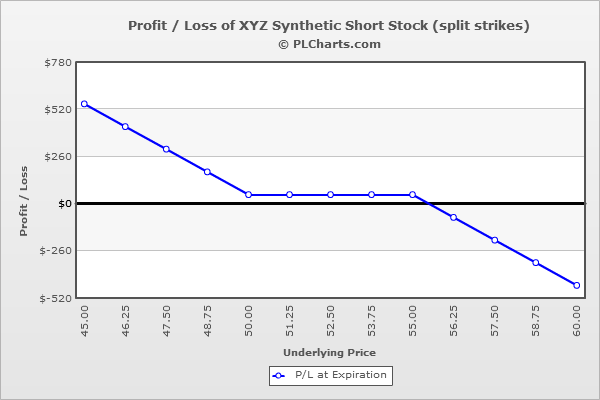

XYZ is at $52.50. Instead of shorting the stock, you sell (1) 55 call for $3.00 and buy (1) 50 put for $2.50. The net credit is $0.50.

If the stock moves down to $40 at expiration, the 50 put will be worth $10 (netting you a profit of $7.50), and the 50 call will be worthless (netting you a profit of $3.00). Your total profit is $10.50, and your profit continues to grow as the stock moves down.

If the stock moves up to $60 at expiration, the 50 put will be worthless (netting you a loss of $2.50), and the 55 call will be worth $5 (netting you a loss of $2.00). The total loss is $4.50, and your loss continues to grow as the stock moves up.

If the stock in unchanged on expiration day, the 50 put will be worthless (netting you a loss of $2.50), and the 55 call will also be worthless (netting you a profit of $3.00). The total gain is $0.50. This is your gain anywhere between $50 and $55.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|