Married Put

Risk: limited

Reward: unlimited

General Description

Entering a married put entails buying puts and buying the underlying stock at the same time. It's the same as a protective put except you don't already own the stock. Also, it has the same risk profile as a long call, so it's considered a type of synthetic long call.

(draw a married put risk diagram here)

The Thinking

You want to buy a stock because it's paying a dividend soon, but you want some downside protection just in case it drops. You buy the stock and buy puts for insurance. If the stock rallies, you keep the stock and lose the premium paid for the puts. If the stock drops, you have some downside protection.

Example

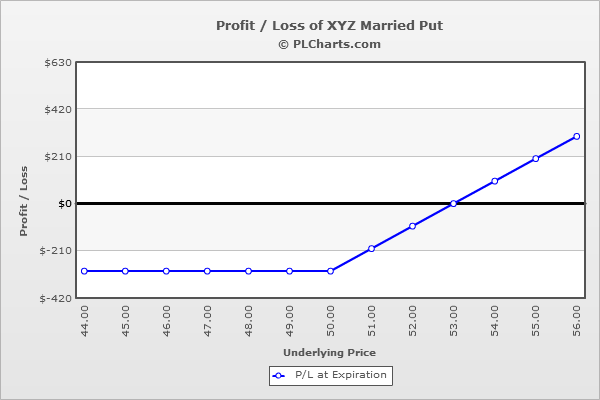

XYZ is at $50. You want to buy the stock but are weary of a move down because the overall market is weakening. You buy 100 shares of the stock at $50 and then buy (1) 50 put for $3.00 for some downside protection. You hope the stock moves up, but if it happens to move down, you have some protection.

If the stock closes above $50, the puts expire worthless, and you’re out the net debit. At least you keep the stock and benefit from ownership (stock appreciation, dividends etc.)

Below $50, the loss from the stock will be countered by a gain from the long put. Your loss is capped at $3, the put premium paid.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|