Variable Ratio Write

Risk: unlimited

Reward: limited

General Description

Entering a variable ratio write entails selling (1) lower strike call and (1) higher strike call for every 100 shares of stock you own. It's similar to a ratio call write expect instead of selling (2) calls at the same strike, consecutive strikes are used.

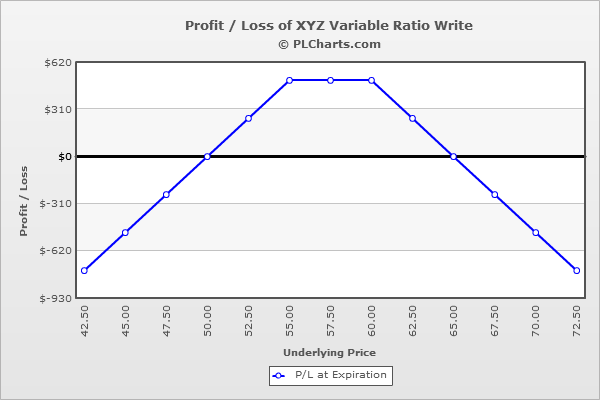

(draw a variable ratio write risk diagram here)

The Thinking

You are long a stock and confident it will trade in a tight range and won't move much from its current level. To profit from a lack of movement, selling options, which benefit from time decay, is a good route to go. If the stock moves up a little or down a little, you'll profit. It would take a relatively big move for the trade to lose you money. Using staggered strikes widens the profit zone at the expense of lowering the profit potential.

Example

XYZ is at $57.50. You buy 100 shares of stock at $57.50 and then sell (1) 55 call for $4.00 and (1) 60 call at $1.00. The net credit is $5.00, not including the stock.

Between the two strikes ($55 and $60), max profitability is achieved. As an example, at $57.5, the stock is unchanged, so there’s no profit of loss with the long stock position. The 55 call will be worth $2.50 ($1.50 gain), and the 60 call will be worthless ($1.00 gain). The net is a $2.50 profit.

Above the highest strike, the gain from the long stock will be countered by a loss from one of the short calls, and the other short call will lose you money point-for-point with the underlying. For example, at $65, the stock will be up $7.50, the 55 call will be worth $10 ($6.00 loss) and the 60 call will be worth $5 ($4.00 loss). The net of this is a $2.50 loss.

Below the lowest strike, all calls expire worthless, and your loss will be linked to the stock moving against you. For example, at $45, the 55 and 60 calls expire worthless ($4.00 profit and $1.00 profit), and the stock will be down $12.50. The net of this is a $7.50 loss.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|