The Collar

Risk: limited

Reward: limited

General Description

Entering a collar, or protective collar, entails buying a lower strike put and selling a higher strike call on a stock already owned. Essentially, a collar is a covered call with a protective put.

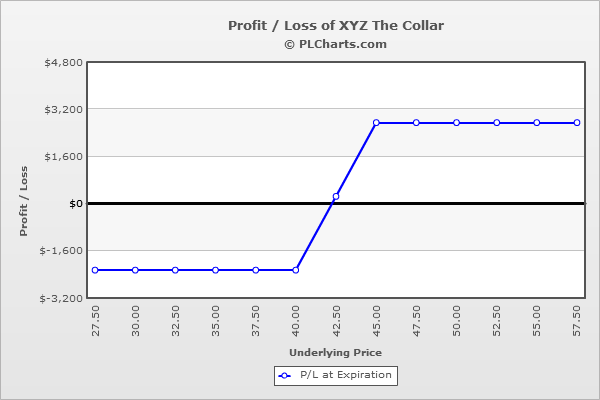

(draw a collar risk diagram here)

The Thinking

You're long a stock and wish to remain long. You sell out-of-the-money calls to generate cash flow (covered calls), and to protect yourself from a move down, you buy out-of-the-money puts. Ideally the underlying trades flat or slightly up. As long as the stock closes below the call strike, you maintain ownership of the stock and keep the call premium, but you'll probably lose the put premium (semi expensive insurance). You won't make much with this strategy, but periodic 3% gains add up if you're playing with big numbers. It's like getting a monthly or quarterly dividend.

Example

You've been the proud owner of 1000 shares of XYZ for several years. It's a quiet stock which has treated you well. You'd like to use covered calls to generate a little cash flow but also want some downside protection just in case the stock drops a bunch. The stock is at $43. You sell (10) 45 calls (covered calls) for $1.50 each and then buy (10) 40 puts for $0.75 for downside protection.

If the stock rallies to $45, the calls will expire worthless, and you'll profit $1.50 per contract, and the puts will also expire worthless, and you'll lose $0.75 per contract. The net of this is a profit of $0.75 per contract, and you would still own the stock which is now up 2 bucks from the time the trade was initiated.

Above $45, you’ll still make $0.75 per contract, but the stock will get “called” from you. That is unless you don't exit the option trade.

If the stock drops to $40, the calls expire worthless, and you'll profit $1.50 per contract, and the puts will have will also expire worthless, and you'll lose $0.75 per contract. The net of this is a profit of $0.75 per contract, and you would still own the stock which is now down 3 bucks from the time the trade was initiated.

Below $40, your P&L will be the same because the loss from the stock will be countered by a gain from the long puts leg.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|