Long Call Butterfly

Risk: low

Reward: low

General Description

Entering a long call butterfly entails buying (1) lower strike call, selling (2) middle strike calls and buying (1) higher strike call (same expiration month, strikes are equal distance). It's essentially a combination of a lower strike bull call spread and a higher strike bear call spread, and it's similar to a long call condor except the short calls use the same strike.

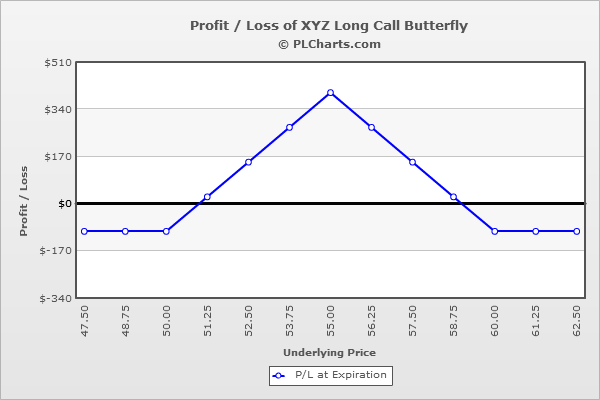

(draw a long call butterfly risk diagram here)

The Thinking

You're confident a stock will trade in a tight range and not move much from its current position. You employ a lower strike bull call spread, which achieves max profitability when the underlying rallies, and a higher strike bear call spread, which achieves max profitability when the underlying drops. If you're correct, if the stock doesn't stray too far from the middle strike, you'll make money on both legs of the overall strategy.

Example

XYZ is at $55.00, and you're fairly certain the stock won't move much. You buy (1) 50 call for $6.00, sell (2) 55 calls for $3.00 each and buy (1) 60 call for $1.00. The net debit is $1.00.

Below the lowest strike, all calls expire worthless, and your loss is the net debit paid when the trade was initiated.

Above the highest strike, all calls are in-the-money and exactly cancel each other out. Your loss is the net debit paid when the trade was initiated. For example, if the stock is at $65, the 50 call will be worth $15 ($9.00 profit), the 55 calls will be worth $10 ($7.00 loss per contract) and the 60 call will be worth $5 ($4.00 profit). The net of this is a $1.00 loss.

At $55 (middle strike), max profitability is achieved. The 50 call will be worth $5 ($1.00 loss), the 55 calls will be worthless ($3.00 profit per contract) and the 60 call will be worthless ($1.00 loss). The net of this is a $4.00 profit.

The PL chart below graphically shows where this trade will be profitable and at a loss.

|